Why are my 2nd Half imports not calculating my year-end balances correctly?

Before importing the 2nd half trial balance into CaseWare Working Papers, it is important to understand whether the 2nd half is a Periodic movement from the first half or whether it is the year-to-date balances. Understanding this concept and how it relates to importing the data will help you setup your engagement appropriately.

The Difference between Year-to-date Vs Periodic movements

Year-to-date balances

If the client has provided you with the year-to-date balances, this means the actual result of these balances should form the final yearly trial balance in your CaseWare engagement file.

For example, if the trial balance being imported has cash on hand at $75, the Cash and Cash Equivalent leadsheet (i.e. B.01) should display the balance as $75.

Periodic Movements

If the client has provided you with the movement, this means the balance should be added with the 1st half balance to form your final yearly trial balance in your CaseWare engagement file.

For example, if the trial balance being imported has cash on hand at $75, and the 1st Half was $45, the Cash and Cash Equivalent leadsheet (i.e. B.01) should display the balance as $120.

Importing the 2nd Half as Year-to-date or Periodic movements

In this example, we will use a simple trial balance with a 30 June 2019 year-end. The data acquired from the client includes:

- 31 December 2018 - 1st Half of the Current Year.

- 30 June 2018 - 2nd Half of the Prior Year.

- 31 December 2017 - 1st Half of the Prior Year.

Importing 2nd Half as Year-to-date balances

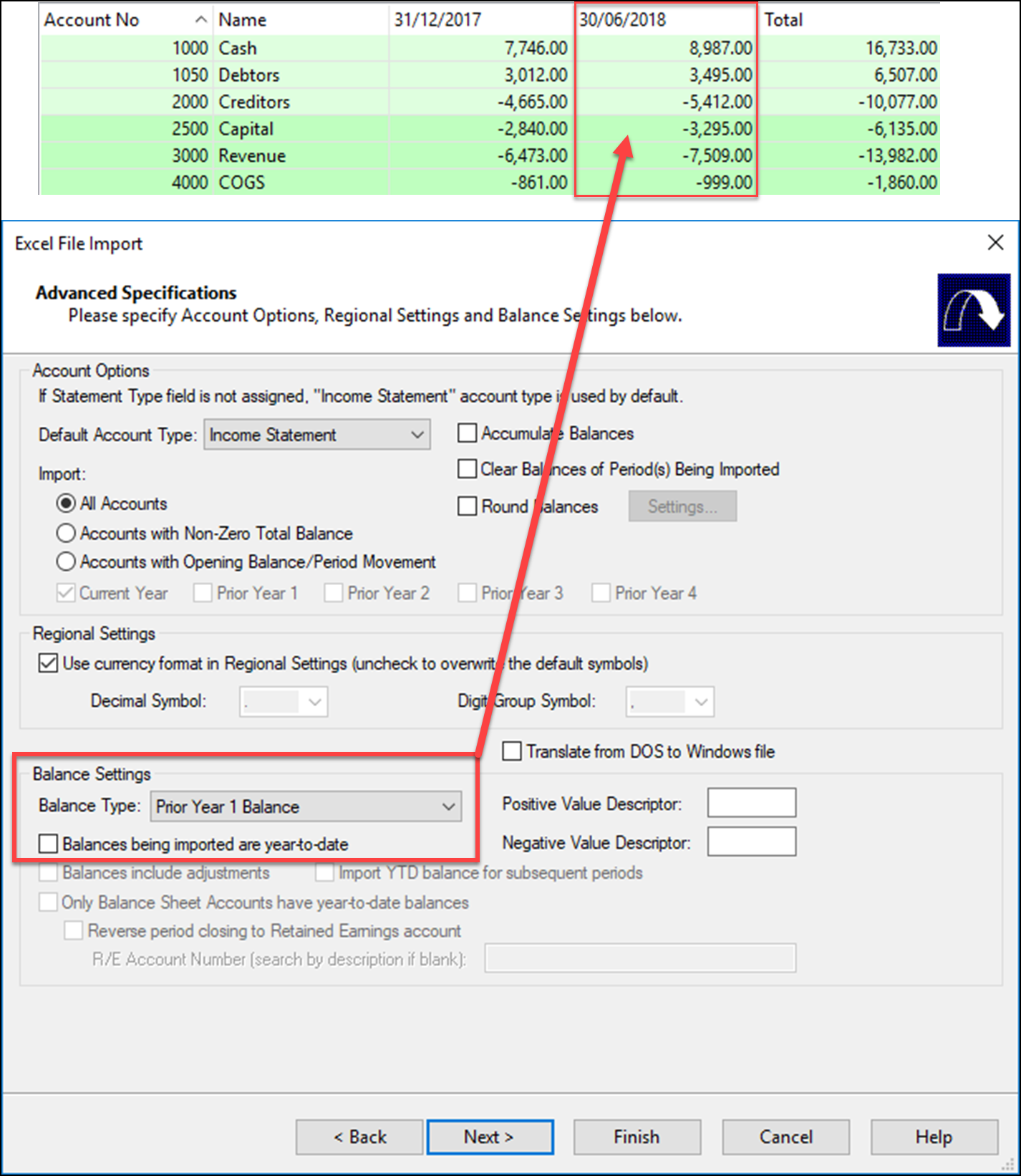

Lets assume that the 2nd Half of the Prior year are Year-to-date balances. In order to import this appropriately so that it does not add to the 1st Half, we need to make a few additional selections in the Advance Specifications screen:

- Select the appropriate Balance Type (For this example we only have a 2nd Half for Prior Year 1 Balances).

- Check the option Balances being imported are year-to-date.

You can see the result of the Trial Balance below that CaseWare automatically offsets the 2nd Half to ensure the total balance is consistent with the balances in the trial balance source file.

Note: If you have multiple periods with a 2nd half component, you will need to repeat steps above for those periods as well (e.g. 2nd half for Current Year Balances).

Importing 2nd Half as Periodic Movements

Lets assume that the 2nd Half of the Prior year are periodic movements and we want these to add to our 1st Half Prior Year data to calculate our year-end balances. In this example we will not select anything within the Balance Settings area of the Advance Specifications screen.

You can see the result of the Trial Balance below that CaseWare is now actually adding the two halves together to establish the year-end balance.

Related Articles

Aligning a Cloud engagement Year End date with CaseWare Working Papers.

CloudBridge will align the Year Start Date and Year End Date with the CaseWare Working Papers Year End Data and Year Beginning Date if the dates are not aligned. Before first data transfer: After first data transferHow do I clear balances if I have incorrectly imported a trial balance?

When you are importing a trial balance into CaseWare Working Papers (especially when required to import multiple periods at a time), it may be required to clear the balances for a specific period if something has gone wrong with the import. Using the ...What are the practical issues when setting up a Half-yearly file in CaseWare

Setting up a half- year file: Setting up a half-year CaseWare engagement file is the most crucial phase to ensure correct presentation of data. In order to start using CaseWare / FinancialsIFRS to report half-yearly data, it is imperative that you ...How to Roll Forward an Engagement File

Note: There is only one correct way to roll forward an engagement file (whether it is an audit or financials file). 1. From the Engagement tab, select Year End Close to display the "Year End Close and Roll Forward" dialog. 2. Press the Browse button ...What data is required for me to setup a Half-Year engagement?

Setting up a half-year CaseWare engagement file is the most crucial phase to ensure correct presentation of data. In order to start using CaseWare to report half-yearly data, it is imperative that you contain the following information as a minimum ...